|

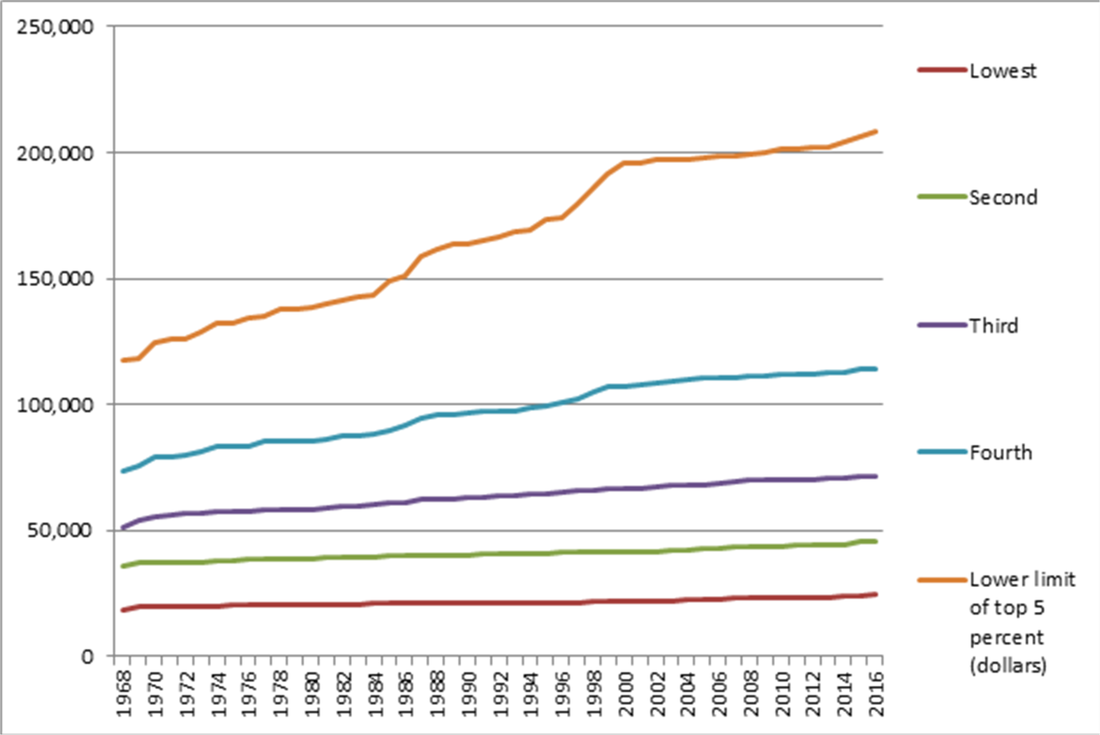

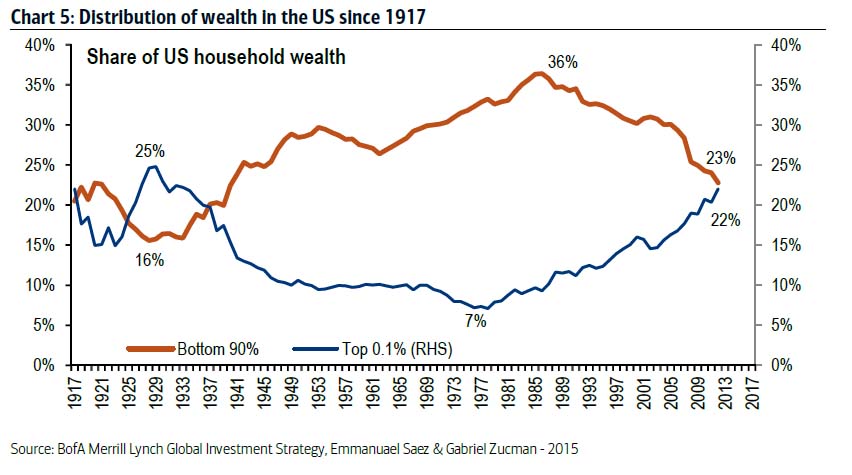

So; I don't BLOG much; but I wanted to write this here so I can reference it easily. There is a misconception as to what is REALLY at stake in the current political-economic climate both here in the US and abroad. There is a misconception that a "free-market" is one that is "deregulated." Here's some data and a brief look at things. So; here’s the income trajectories of the lower four deciles of the US income distribution (I just pulled this off the BLS website and converted it into a graph in excel.) Consider the top 0.1% in wealth versus bottom 90%: CLICK HERE The top don’t spend their money. Instead, it’s all put into financial markets where it’s tax insulated, and never even enters the real world again. It just sits and grows as corporate profits increase (at an increasing rate). All the while, the wealthy lobby to get more deregulation to guarantee that their now completely synthetic fortunes continue to grow, while earned wages stagnate or fall (in real terms after accounting for inflation)… The top .1% doesn’t have to do anything to “earn". They just enjoy the current laws and what they guarantee; more to come. 1981 was a turning point with massive tax reforms and corporate legislation that gave corporations more rights than individuals. Deregulation has continued since. Bill Clinton was the worst; signing into law the Gramm-Leach-Bliley act. It effectively opened the floodgates for financial institutions to both aggregate in size and scope, but to also pass all risk onto the unknowing (fraud is still rampant among the rating agencies and companies… there is simply too much vested interest.) Here’s a speech by Sen. Dorgan of North Dakota BEFORE the signing of GLB in 1999: CLICK HERE. Deregulation is NOT good for “free markets.” Free-markets are by definition: a market where ALL costs and benefits of goods and services are fully accounted for in the market price. Free-markets was a term that was aimed at the CONSUMER’s freedom to choose… NOT a corporations freedom to do WHATEVER is necessary to increase profits (through tax-loopholes, lobbying and re-writing of corporate law etc). If Jefferson were to step into today’s world; he’d abhor what he saw. Here’s the top 0.1% versus the bottom 90%:

You can see clearly: it’s financial reform after the OPEC oil crisis in the late 70s where things make a dramatic change from the post-war time of 1945 through 1980. 1981 started things; and it’s only continued. We’re the blind fools (household's earning $250K or lower. We’re the ones paying a HUGE percentage of our earned incomes in taxes; which has a HUGE impact on our daily lives… while both the mega-wealthy and corporate entities enjoy a tax-free life. They live without any real economic tradeoffs. Their personal economic well being cannot ever be put into jeopardy again… they're completely insulated. Corporations can go bankrupt while their personal fortunes remain insulated. They are also insulated through structured finance to eliminate their effective taxes to nearly 0%. (I'll edit for clarity/spelling/punctuation later... this is informal; and for discussion purposes).

2 Comments

Joel B

1/9/2016 01:47:07 pm

A few quick thoughts:

Reply

1/9/2016 06:44:45 pm

Hey Joel,

Reply

Leave a Reply. |

AuthorJustin Hicks is an applied microeconomist; writing on innovation and related themes... Archives

December 2021

Categories |

RSS Feed

RSS Feed